South Florida M&A: The Opportunity Corridor

We recently closed the sale of Bova Fresh to CREO Capital Partners — a deal that reinforced a belief I’ve held for years: South Florida is no longer just a tax haven; it’s a frontier for deal-making. From Miami’s global capital gateway to Palm Beach’s deep pool of capital and legacy businesses, the region has become a true “Power Corridor” for middle-market transactions.

For business owners, investors, and advisors, the question isn’t if activity will accelerate — it’s how you’ll position yourself to lead in this dynamic market.

The Emergence of a Power Corridor

At ButcherJoseph & Co., we’ve long believed the best opportunities emerge where capital, talent, and entrepreneurial drive converge. Nowhere is that more evident than in South Florida, which has evolved from a wealth refuge into one of the country’s most dynamic ecosystems for private equity and middle-market M&A.

What makes South Florida especially unique is its dual identity. On one end, the region is anchored by some of the world’s most recognizable private equity platforms, including H.I.G. Capital, Sun Capital Partners, and Trivest Partners. These firms provide the scale, credibility, and global reach that increasingly illustrates that South Florida can compete with established financial hubs like New York and Chicago.

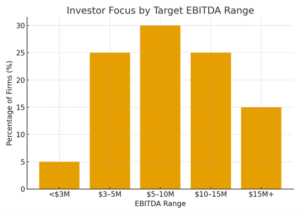

At the same time, the true vitality of the market emerges in the middle and lower-middle market. Here, dozens of specialized firms target companies in the $3 million to $15 million EBITDA range — the exact profile that dominates Florida’s economy. These firms reflect the entrepreneurial character of the region, combining operational expertise with founder-friendly approaches. Their presence underscores a defining feature of South Florida deal-making: value is not created through financial engineering alone, but through operational excellence in a specific niche, and genuine alignment with owners and sellers who often have unique connectivity to markets in Latin America.

Investor Focus in South Florida by Target EBITDA Range

Source: Preqin Private Equity Online

Lessons from Bova Fresh

Our recent work with Bova Fresh, a food distribution company based in Palm Beach County, brought post deal experience of South Florida’s market into sharp focus. First, the transaction was competitive, drawing interest from a mix of strategic acquirers and private equity firms. But what made the deal particularly instructive was the combination of factors at play: a dynamic founder team ready for its next chapter, a business with strong local roots and national reach that sourced product from across Latin America, and a buyer universe eager to invest in food distribution and logistics — all factors for which Florida has natural advantages.

Guiding Bova Fresh through this process reinforced for us how South Florida embodies both opportunity and complexity. Owners are weighing succession, liquidity, growth, and legacy. Buyers bring sophisticated operational and capital strategies along with specific investment goals. And in between, there is a need for advisors who can navigate nuance, align expectations, and deliver outcomes that preserve value for all stakeholders.

Sector Depth and Growth Themes

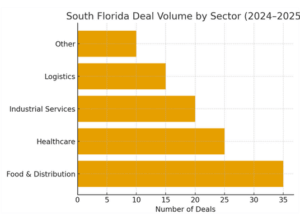

The opportunity corridor is not defined by one industry. In addition to food distribution, logistics, healthcare services, aerospace & defense, and environmental services are highly active sectors. Healthcare aligns with demographic shifts and migration trends. Aerospace and defense benefit from Florida’s Space Coast and military presence. Environmental and industrial services are propelled by infrastructure and sustainability spending. Each represents an arena where capital and tailored strategies are flowing in, and where professionalization and scale can create outsized value.

South Florida Deal Volume by Sector (2024–2025)

Source: PitchBook Regional M&A Reports

A New Era of Funding Sources

South Florida reflects the changing face of deal finance. Beyond private equity sponsors, the region is attracting family offices with roots in Palm Beach, private credit funds eager to provide flexible debt capital, and cross-border investors leveraging Miami’s international gateway status. This diversity of capital sources expands options for business owners — but also requires more careful navigation of deal structures and partners.

Why Business Owners Should Pay Attention

For business owners across the corridor, the implications are clear. This is a market where capital is abundant, but the right partner matters. A founder seeking to transition a business will find no shortage of suitors, from sector specialists like AE Industrial Partners and Cambridge Capital to generalist firms with deep operational playbooks. Yet, more capital also means more complexity — and in many cases, more pressure to professionalize and prepare before engaging in a process.

The best outcomes are being achieved by owners who think two or three years (or more) ahead, who invest in strengthening operations and financial reporting, and who align with advisors capable of connecting them to the right capital partner. In a market as competitive as South Florida, preparation is not optional; it is the difference between capturing a premium valuation and settling for a middle-of-the-road outcome.

ESOPs as an Exit Strategy

One theme especially relevant to this region is the role of employee ownership. South Florida is home to thousands of founder-led and family-owned businesses approaching succession. For many of these owners, the priority isn’t just price — it’s legacy, culture, and continuity. ESOPs provide a powerful alternative, allowing owners to achieve liquidity, reward employees, and maintain independence while still participating in future growth. In a market where “founder-friendly” is more than a buzzword, employee ownership is a natural fit.

Looking Ahead: South Florida’s Next Chapter

The trends propelling South Florida’s rise show no signs of slowing. The migration of high-net-worth individuals, family offices, and financial professionals into the region will continue to deepen the talent pool. At the same time, the generational transition of baby boomer-owned businesses — the so-called “great wealth transfer” — will bring a steady pipeline of companies into the market. Add to that the ongoing consolidation of service-based industries, and the result is an ecosystem built for sustained deal flow.

Unlike other emerging hubs such as Texas or the Carolinas, South Florida offers a unique blend of sector diversity, cross-border capital access, and a deeply entrepreneurial business base. For ButcherJoseph, this is not just another regional market. It’s a unique ecosystem where legacy businesses, sophisticated investors, and forward-looking advisors intersect.

For us, the opportunity is clear. By bringing our expertise in M&A and employee ownership to bear in this unique corridor, we can help owners achieve liquidity, preserve legacy, and align with capital that understands their vision. In doing so, we’re not only advising on transactions — we’re shaping the next chapter of South Florida’s economic story.

ADDITIONAL RESOURCES

- ButcherJoseph Advises Bova Fresh on its Sale to CREO Capital Partners

- ButcherJoseph Advises ERW Site Solutions on a Sale to Its Employees

- ButcherJoseph Advises Jim’s Formal Wear on a Sale to Its Employees